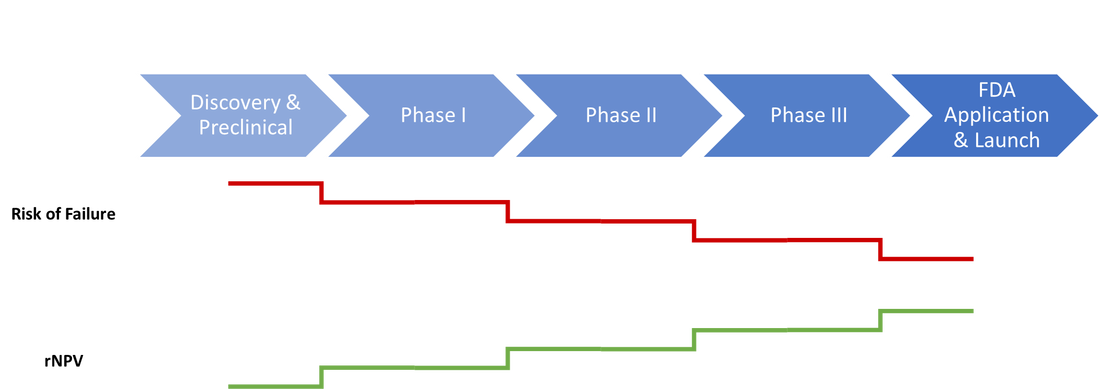

Asset Valuation and Risk AssessmentIn the second part of this two part series, we will be discussing techniques to value assets identified from a search, as well as steps companies can take to mitigate risk. If you missed the first part of this series click here for – “Early Stage Asset Identification“. Asset Valuation Once an asset or technology has passed the preliminary screening process, the next step is to determine its worth. Due to the volatility and low success rates of candidates in the biotech and pharmaceutical space, this can be a complicated process. The main factors to consider during this process are the future revenue of the product (broken into components of market size, competition, and pricing), the costs of development (including both financial and temporal costs), and risks encountered along the way (including research, regulatory, and competitive risks). When attempting to value an asset, many start with a basic cash-flow analysis. The result may be in the right ballpark, but in the instance of high-risk biotech ventures, it tends to over-inflate the expected value by underestimating risk. In this article, we cover in-depth methods for generating more accurate estimates.  Calculating Value: The Basics The predominant approach to assessing the value of a developing biotechnology or pharmaceutical product is an advanced version of a net present value (NPV) calculation. The risk-adjusted net present value (rNPV) as described by Stewart is based on understanding future revenues, costs, risk, and time-value [1]. The first step in obtaining an rNPV estimate is to look at the expected revenue. For indications with existing treatments, this can be estimated by looking at current sales. Similar indications can also be used as analogs if the area is not addressed or if a more robust range is desired. One piece of this component is to estimate the market share. This will be based on improvements relative to current treatments as well as number of competitors, pricing difference, and market access. This percentage can then be applied to the annual market to estimate the annual gross revenue of the candidate product. This number can then be further divided using industry standard percentages to show the gross to the manufacturer, the biotech developer, and the inventor (if this is separate from the developer). In Stewart’s example, the percentages break out to 60%, 35%, and 5% respectively, but current industry rates should always be considered. Once the annual return is estimated, it can be transformed into an overall expected value by estimating the number of patent-protected years it will have on the market. This should be calculated by the total patent years minus the years to finish development and get to market. Next, the costs should be considered. The cost of clinical trials can be bench marked against similar products in the space to estimate costs. This should be done for each stage through submission to the FDA. After determining the value and costs, these numbers should be adjusted for risk. The risk-adjusted value is the likelihood of success multiplied by the expected value. The risk-adjusted cost for each stage is the expected cost multiplied by the ratio of the overall chance of success to the chance of success at that stage. The result is an estimate that adjusts the expected value down to reflect the probability of success and adjusts the expected costs down to reflect costs avoided by early failure and probability of success. Finally, both the risk-adjusted payoff and the risk-adjusted costs must be discounted according to traditional NPV methods. The discount rate here should reflect the typical expectations within the industry, which may change over time. The example shown by Stewart chooses 20%, but this should be reevaluated at the time of the valuation. The difference between the two numbers calculated here is the final rNPV of the technology. For a more complete mathematical explanation of this method, please see the original Stewart article. As a product moves through each phase of development successfully, the overall risk of failure decreases while the rNPV increases. This makes deals at later stages lower-risk, but more expensive investments. Calculating Value: Advanced Methods for Drug Discovery While the rNPV methods described above are well-suited to determining the value of a developing technology, there is increasing emphasis on early-stage ventures. Andreas Svennebring and Jarl Wikberg have developed advanced methods to adapt rNPV estimates to include the initial drug discovery process [2]. The three methods proposed handle the probability of finding a compound during the discovery period and how this affects NPV. In the first method, probability is assumed to be stable. In the second method, probability is adjustable to scale with fluctuations in discovery cash flow throughout the process. In the third method, it is assumed that multiple compounds may be pursued for development. The methodology of each is highly detailed – if it is necessary to value discovery stage assets, please see the original publication. Additional Factors Risk-adjusted NPV should serve as one of the main supports of a valuation effort, but research has also demonstrated that there are other factors at play [3]. In a summary of deals made by over 100 companies, Arnold et al. highlighted several of the most significant factors. In general, each stage in development (from preclinical research through post-phase III trials) corresponds with approximately a 22% increase in deal value. This does not affect the methodology of evaluating a deal, but does suggest the scale of the difference in value between an asset in Phase I and Phase III. Similarly, global deals tend to be about a third larger than geographically restricted deals. More compellingly, however, a large amount of the variation in deal size was not attributable to quantitative factors. Based on the deals analyzed in this study, qualitative criteria may be responsible for more than half of this variation. The main factors suggested revolved around perception, including the quality of the management team and scientists, the business strategy, and the public attitude toward the therapeutic area and biotech industry. While the rNPV methods discussed above should provide a starting point for valuation, it is worth considering these less tangible factors closely. In order for an asset to truly have value, it must be managed by leadership that can help it succeed as well as being backed by a solid scientific foundation. Framing a Deal Once a valuation range has been reached using rNPV as a basis, it is important to consider how this will factor into potential licensing agreements. As mentioned above, rNPV can able to be calculated for each stage of candidate development. This makes it easy to introduce payments and royalty rates based on various milestones of the project completion. As each development milestone is completed, the probability of overall success increases. To reflect this, milestone payments tend to become larger for targets further along the development track. Examining the differences in calculated value for the product at each stage of development is a good place to start for determining the timing and magnitude of milestone payments. Comparison to industry standards should give an idea of what is required in terms of royalty rights. Future series will cover the deal making and negotiation process in more detail. It is important to note, however, that the valuation established using rNPV (or other methods) provides an accurate appraisal, but does not necessarily dictate the final deal price. This will depend on the number of competitors looking to license technologies within the therapeutic area (demand) as well as other potential licensees (competition). [1] Stewart, J. J., Allison, P. N., & Johnson, R. S. (2001). Putting a price on biotechnology. Nature Biotechnology, 19, 813-817. doi:10.1038/nbt0901-813 [2] Svennebring, A. M., & Wikberg, J. E. (2013). Net present value approaches for drug discovery. SpringerPlus, 2(1), 140. doi:10.1186/2193-1801-2-140 [3] Arnold, K., Coia, A., Saywell, S., Smith, T., Minick, S., & Löffler, A. (2002). Value drivers in licensing deals. Nature Biotechnology, 20(11), 1085-1089. doi:10.1038/nbt1102-1085 Comments are closed.

|

Archives

May 2020

Topics

All

|